Children under the age of 18 are not legally allowed to sign documents.

Can i open a bank account for my child barclays.

Our children s bank account is perfect for 11 15 year olds looking to save.

How do i open a bank account for my child.

When the child turns the appropriate age 18 or 13 if you convert it to a checking account you can go to the bank and remove your name.

After the child reaches 18 we will convert the account to an adult instant access savings account in your name.

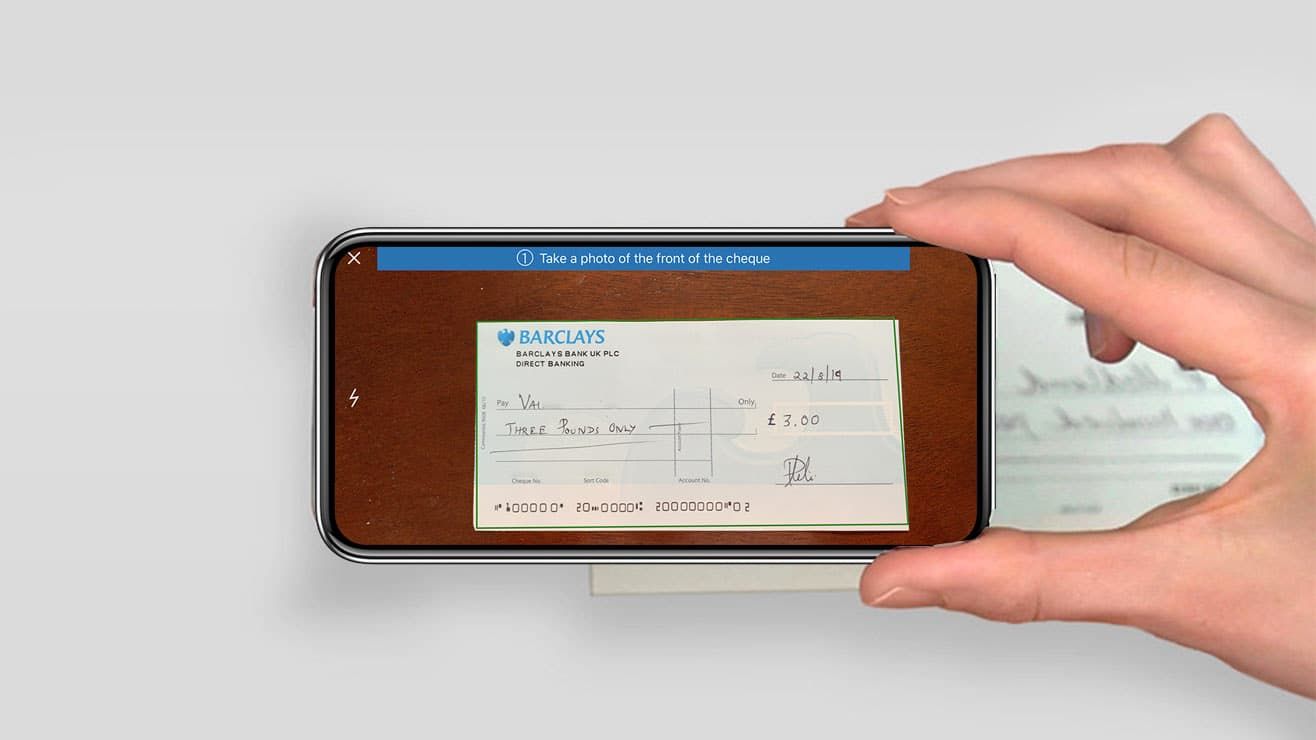

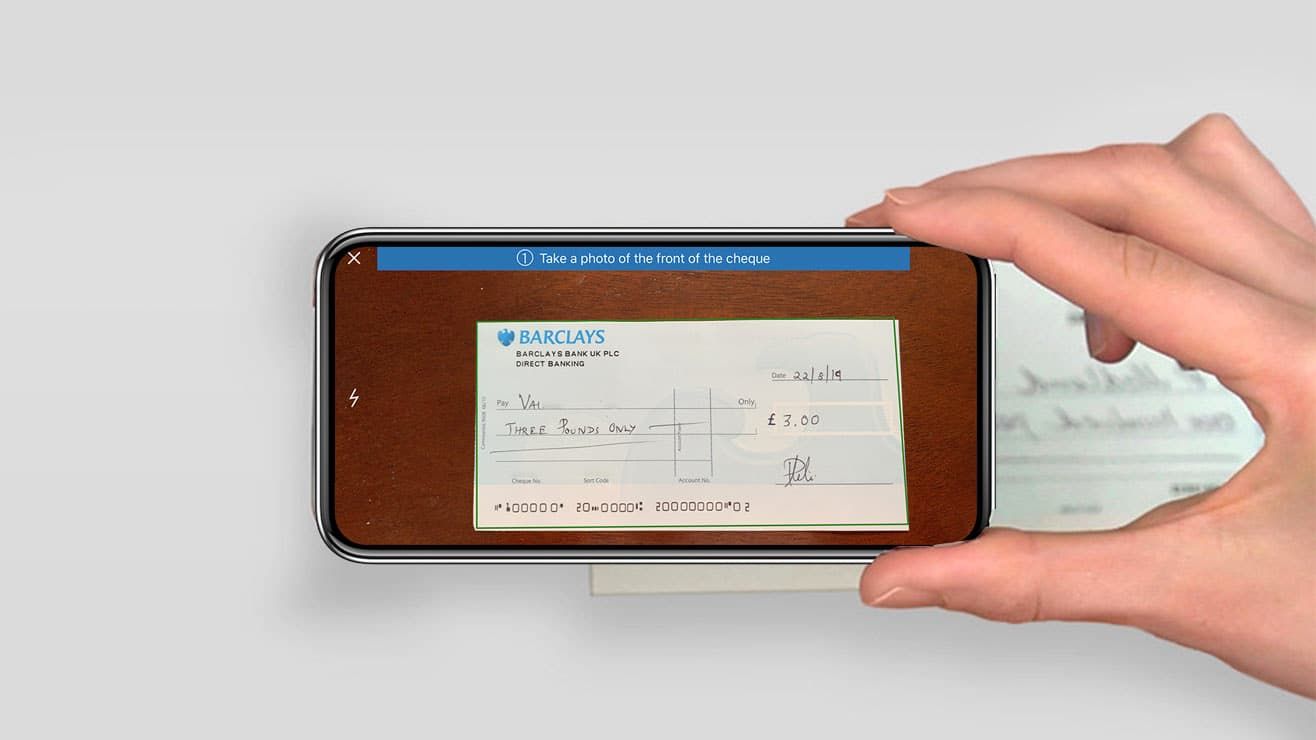

The quickest way to open your account is by getting the barclays app on your phone or device and applying from there.

The adult will manage the account as trustee for the child.

Then just link your kids savings account to your existing capital one account or personal checking account at any u s.

As a result you ll need to open the account with your name on it as well.

They can do this when you first open your.

The opening hours and phone number of my barclays branch.

Barclays bank uk plc and barclays bank plc are each authorised by the prudential regulation authority and regulated by the financial conduct authority and.

Whether you d like a structured or flexible approach to saving for your child s future see how our accounts can help.

You can open a savings account for kids in your name alone or in your name and your kid s name.

If you re 11 or 12 you ll need permission from your parent to access the barclays app.

Children s bank account barclayplus.

The amount of money you have in your account.

That s also the way you make deposits to and withdrawals from your account with us.

You can manage your account in branch or using online telephone banking or the barclays app provided you re registered.

Apply to open an account that lets you earn rewards 1 for banking with us and an app 2 that helps you keep your money under control.

Setting up the account.

This is known as your annual exemption.

Open an account with as little as 1 and enjoy instant access.

For flexible rewarding banking.

Many banks will let 16 year olds apply independently but for children under 16 a parent or guardian will usually have to open the account in branch.

As a grandparent you can also give a wedding gift of up to 2 500 and as many gifts of up to 250 to anyone who hasn t already benefited from any other.

With a standard joint account each account holder has 100 access to the funds so either the adult or the child can drain the account and rack up overdraft fees unless the bank restricts what the child can do.

Joint account risks.

If we re able to offer you an account you can start using it straight away in the app.

Keep that in mind before you set your child loose with a large available balance.

Opening an account during the coronavirus situation.

You will need to provide a birth certificate or passport plus a recent household bill or bank statement to prove that you live at the same address.